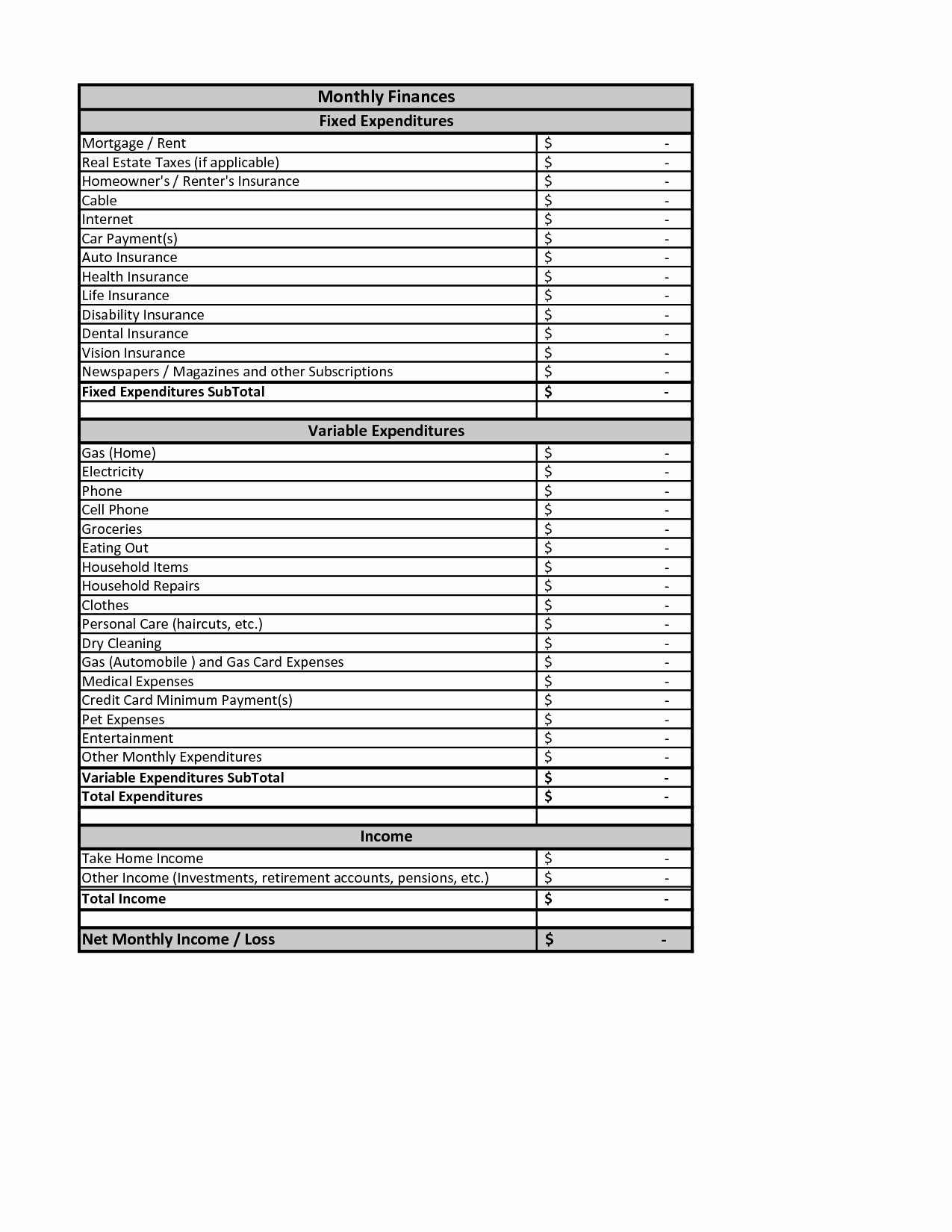

Changes in your personal or family situation.Recognizing these changes gives you the opportunity to make necessary adjustments. Results that are significantly different than expected can reduce the effectiveness of your plan. If so, you may need to make adjustments to the accounts that are currently providing income. You may have started to receive Social Security payments or required minimum distributions (RMDs) from retirement accounts. Your risk tolerance may change at this time, which would affect your asset allocation. If you've recently retired, you may need a new strategy to help maximize your retirement income. Your annual financial review checklist: What to look for For example, capital gains rates or holding periods could rise or fall, or retirement plan contribution rules could shift. This Excel template can help you track your monthly budget by income and expenses. Changes in tax laws could affect your portfolio for better or worse. Section 1142 and Section 1144 National Defense Authorization Act (NDAA) 2019 DoD Directive 1332. Your income may have increased or decreased, your retirement plans may have changed, or your portfolio may need modification. SOLDIER FOR LIFE - TRANSITION ASSISTANCE PROGRAM Materials to Support: Personal Financial Planning for Transition October 2019 AUTHORITY: 10 U.S.C. Even if your portfolio has remained the same, your situation may have changed. If the value of one of your assets grows substantially, it may make up a large portion of your portfolio, reducing your level of diversification and increasing your risk. You may be less diversified than you think.For example, what started as a 50/50 allocation between stocks and bonds may now be 45/55.

Over time, different assets may grow at different paces. Your asset allocation could be off balance.Compare projected costs with actual costs to hone your budgeting skills over time. Input your costs and income, and any difference is calculated automatically so you can avoid shortfalls or make plans for any projected surpluses. It's important to monitor your retirement and investment accounts regularly and make adjustments annually to stay on track. This Excel template can help you track your monthly budget by income and expenses. Many changes can affect your investments during the course of a year. An annual financial review gives you a chance to evaluate your financial position

0 kommentar(er)

0 kommentar(er)